Behind Every Smooth Closing

Why a Tight Realtor–Appraiser Relationship Still Wins in 2025

Multiple offers, inspection drama, lender overlays—today’s deals have plenty of ways to wobble. One weak link you can control is the hand-off between the listing agent and the appraiser. Get that right and you slash delays, protect prices and keep referrals flowing. Ignore it and you risk blown deadlines, bruised egos and price cuts.

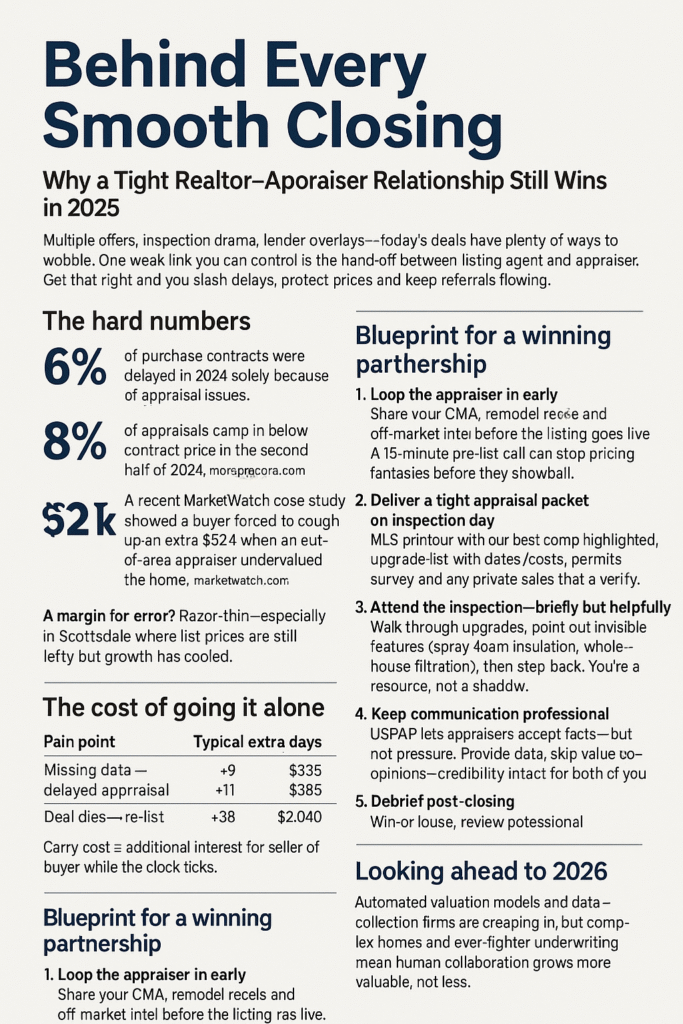

The hard numbers

-

6 % of purchase contracts were delayed in 2024 solely because of appraisal issues. nar.realtor

-

8 % of appraisals came in below contract price in the second half of 2024. mortgageorb.com

-

A recent MarketWatch case study showed a buyer forced to cough up an extra $52 k when an out-of-area appraiser undervalued the home—until a second, local appraisal saved the deal. marketwatch.com

Margin for error? Razor-thin—especially in Scottsdale where list prices are still lofty but growth has cooled.

Five ways strong collaboration saves (or makes) money

-

Realistic pricing from day one

Agents know buyer psychology and competition. Appraisers know paired-sale adjustments and lender rules. Together you price to sell—and land on value. -

Compressed timelines

A clean data packet (MLS sheet, upgrade list, permits) handed over before inspection chops days off turn-time and avoids frantic re-inspect fees. -

Smarter handling of unique homes

Golf-course frontage, mountain views, acreage—your local intel plus the appraiser’s comp math turns a pricing headache into an underwriter-ready story. -

Fewer renegotiations

Shared strategy = fewer low appraisals. If value still lands short, a professional relationship makes a fact-based reconsideration far more likely to stick. -

Bullet-proof reputations

Buyers remember who guided them through the valuation gauntlet without drama. Agents who lose deals to appraisal gaps often lose referrals too.

The cost of going it alone

| Pain point | Typical extra days | Carry cost on $500 k loan @ 7 % |

|---|---|---|

| Missing data → delayed appraisal | +8 | $425 |

| Low appraisal → price fight | +11 | $585 |

| Deal dies → re-list | +38 | $2,040 |

Carry cost = additional interest for seller or buyer while the clock ticks.

Blueprint for a winning partnership

1. Loop the appraiser in early

Share your CMA, remodel receipts and off-market intel before the listing goes live. A 15-minute pre-list call can stop pricing fantasies before they snowball.

2. Deliver a tight appraisal packet on inspection day

MLS printout with your best comps highlighted, upgrade list with dates/costs, permits, survey and any private sales the appraiser can verify.

3. Attend the inspection—briefly but helpfully

Walk through upgrades, point out invisible features (spray-foam insulation, whole-house filtration), then step back. You’re a resource, not a shadow.

4. Keep communication professional

USPAP lets appraisers accept facts but not pressure. Provide data, skip value opinions—credibility intact for both of you.

5. Debrief post-closing

Win or lose, review the final report together. You’ll sharpen market insights and recalibrate pricing for the next listing.

Looking ahead to 2026

Automated valuation models and data-collection firms are creeping in, but complex homes and ever-tighter underwriting mean human collaboration grows more valuable, not less. Expect hybrid reports where an on-site inspection feeds an algorithm—agents who supply clean, verified data will ace that shift.

How I work with Scottsdale Realtors

-

48-hour pre-listing price checks – desktop opinion with three paired sales and adjustment notes

-

Rush full appraisals – inspection within two business days for partnered agents

-

Reconsideration support – free second look at any report I produce if a lender flags issues

Ready to tighten the link? Call Gary at 480-316-0764

or book a 15-minute strategy session. Let’s make your next closing the smoothest one yet.

https://appraisalservicesaz.com/property-appraisal-scottsdale-az/.